The smart Trick of Business Insurance Agent In Jefferson Ga That Nobody is Discussing

Unknown Facts About Home Insurance Agent In Jefferson Ga

Table of ContentsSome Known Incorrect Statements About Auto Insurance Agent In Jefferson Ga The Ultimate Guide To Life Insurance Agent In Jefferson GaHow Business Insurance Agent In Jefferson Ga can Save You Time, Stress, and Money.Home Insurance Agent In Jefferson Ga Fundamentals Explained

, the ordinary yearly cost for a vehicle insurance coverage policy in the United States in 2016 was $935. Insurance coverage likewise helps you avoid the devaluation of your lorry.The insurance policy safeguards you and assists you with claims that make versus you in mishaps. It also covers legal expenses. Some insurance provider offer a no-claim benefit (NCB) in which eligible customers can receive every claim-free year. The NCB may be offered as a discount rate on the premium, making auto insurance coverage more economical.

Numerous factors influence the prices: Age of the automobile: Oftentimes, an older lorry expenses much less to guarantee compared to a newer one. Brand-new cars have a greater market worth, so they set you back more to repair or change.

Specific automobiles regularly make the frequently swiped lists, so you might have to pay a greater costs if you have one of these. When it comes to automobile insurance, the 3 primary types of policies are obligation, crash, and comprehensive.

Some Known Facts About Business Insurance Agent In Jefferson Ga.

Some states require motorists to lug this coverage (https://sketchfab.com/jonfromalfa1). Underinsured vehicle driver. Comparable to without insurance coverage, this plan covers problems or injuries you sustain from a driver who doesn't carry sufficient insurance coverage. Motorcycle insurance coverage: This is a plan especially for motorbikes due to the fact that auto insurance coverage doesn't cover bike mishaps. The advantages of automobile insurance policy much exceed the threats as you can wind up paying hundreds of dollars out-of-pocket for a crash you cause.

It's usually much better to have even more coverage than not nearly enough.

The Social Safety and Supplemental Protection Earnings impairment programs are the largest of a number of Government programs that provide assistance to people with specials needs (Life Insurance Agent in Jefferson GA). While these 2 programs are various in many methods, both are provided by the Social Protection Management and just individuals who have a handicap and meet medical requirements might certify for advantages under either program

Make use of the Benefits Qualification Screening Device to learn which programs may have the ability to pay you advantages. If your application has actually lately been refuted, the Net Allure is a beginning indicate request an evaluation of our decision concerning your eligibility for disability advantages. If your application is rejected for: Medical reasons, you can complete and send the Charm Request and Appeal Special Needs Report online. A succeeding analysis of workers' payment insurance claims and the degree to which absenteeism, morale and hiring excellent employees were troubles at these firms shows the favorable results of offering medical insurance. When compared to organizations that did not use medical insurance, it shows up that providing emphasis resulted in improvements in the capacity to employ great employees, decreases in the variety of employees' settlement insurance claims and reductions in the level to which absenteeism and efficiency were issues for emphasis organizations.

Some Ideas on Business Insurance Agent In Jefferson Ga You Need To Know

Six records have actually been launched, check here including "Care Without Coverage: Inadequate, Too Late," which discovers that working-age Americans without medical insurance are more most likely to get insufficient clinical care and obtain it far too late, be sicker and pass away earlier and get poorer care when they remain in the medical facility, also for acute circumstances like a motor lorry collision.

The research authors additionally keep in mind that increasing insurance coverage would likely cause a boost in genuine resource expense (despite who pays), since the without insurance receive about fifty percent as much treatment as the independently insured. Wellness Matters published the study online: "Exactly How Much Medical Care Do the Without Insurance Use, and Who Pays For It? - Business Insurance Agent in Jefferson GA."

The duty of giving insurance for employees can be a challenging and in some cases pricey job and lots of tiny businesses believe they can not manage it. What benefits or insurance coverage do you legitimately need to provide?

How Home Insurance Agent In Jefferson Ga can Save You Time, Stress, and Money.

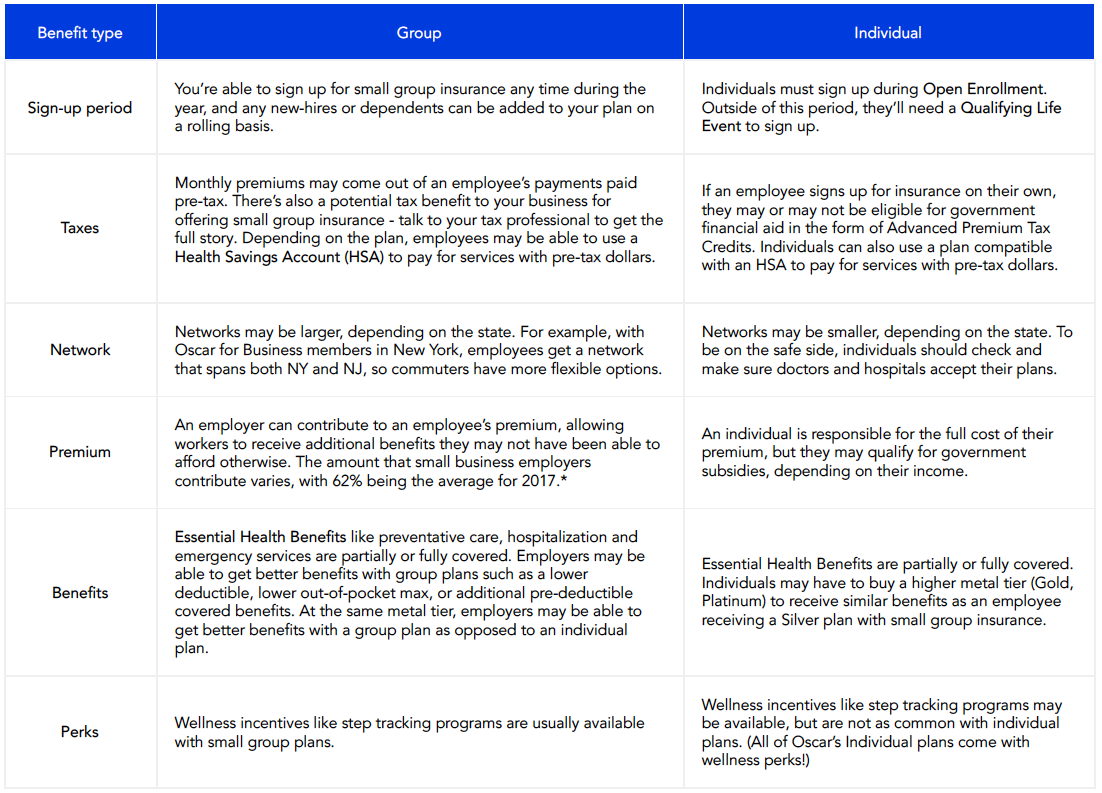

Employee benefits normally start with health and wellness insurance policy and group term life insurance. As part of the health and wellness insurance coverage plan, a company may opt to offer both vision and oral insurance policy.

With the rising pattern in the cost of wellness insurance policy, it is practical to ask workers to pay a percent of the insurance coverage. A lot of companies do place the bulk of the cost on the staff member when they offer access to medical insurance. A retired life strategy (such as a 401k, basic plan, SEP) is usually used as a fringe benefit also - https://flipboard.com/@jonfromalfa1/-the-jonathan-portillo-agency/a-QVrc1HdtQrSL-OlA8mheBQ%3Aa%3A4050036988-84280dfb2d%2Fjonfromalfa.com.